What is a Good Annual Rate of Return?

Understand how to evaluate investment returns, discount rates, and what realistic expectations look like for long-term value investing.

Should you buy HMS Holdings Corp. stock? (NasdaqGS:HMSY). Let's see how it does in our automated value investing analysis system.

Advertisement helps keep Trendshare free for most readers.

Estimate how long you need to hold HMS Holdings Corp. to reach your target.

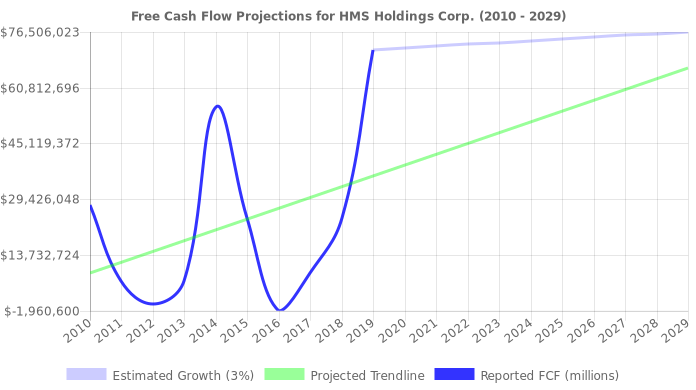

Based on historical returns, we believe that HMS Holdings Corp. can grow its free cash at a rate of about 1%. That's positive!

| Advantages | Disadvantages | Neutral |

|---|---|---|

|

|

|

| HMSY Price (HMS Holdings Corp. stock price per share) |

$36.76 | |

|

|

HMSY Fair Price (based on intrinsic value) |

$17.02 |

| HMSY Safety Price (based on a variable margin of safety) | $11.06 | |

| PE Ratio versus Sector | 132% higher than other Healthcare stocks | |

| PE Ratio versus Industry | 8% lower than other Health Information Services stocks | |

| Cash Yield | 3.43% | |

| Free Cash Flow Jitter | 96% |

This stock has short interest! This means that people have shorted it.

Why does that matter? They've made a bet that price will decrease from where they bought it. Maybe there are financial problems, or maybe there's a value play.

As of the latest analysis, there are 3,724,976 shares shorted. With 87,155,150 shares available for purchase and an average trading volume over the past 10 trading days of 1,110,785, it would take at least 3.353 days for all of the short holders to cover their shorts.

Understand how to evaluate investment returns, discount rates, and what realistic expectations look like for long-term value investing.

Learn when dividend yields signal opportunity versus risk, and how to evaluate dividend sustainability in your portfolio.

Master the methods for projecting company growth rates and earnings, essential for calculating intrinsic value with confidence.

We believe that HMS Holdings Corp. may be worth examining further. It's making money, which is a very positive sign. Is it on sale?

HMS Holdings Corp. looks overpriced right now. If you're looking for a bargain in the stock market, you should probably look elsewhere for a great deal. This might still be a great stock to own—but it's not on sale right now.

Advertisement supports free stock analysis content.

Does HMS Holdings Corp. have a coherent story? Does it have a plan to continue to make money? Is it worth your time? Only you can decide where to go from here. Our investment guide helps you ask the right questions, including how to buy stocks. Use these research links for more information.

This example shows how we apply the Trendshare checklist to HMSY: earnings power, cash generation, valuation, and margin of safety.

We check: business quality, free cash flow, P/E, and margin of safety.