Luby's Stock Price and Value Analysis

Should you buy Luby's stock? (NYSE:LUB). Let's see how it does in our automated value investing analysis system.

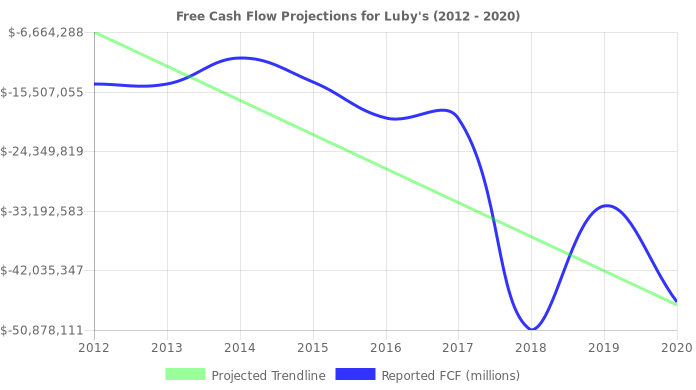

LUB Free Cash Flow Trend

Hmm, we can't give any reliable projection for Luby's's growth rate. The company either has too few years of historical data for us to examine, or it's in the habit of losing money.

None of this means it's a bad stock. Maybe it's new and growing quickly, or maybe it's turning things around. We can't say anything sensible about it, so we won't say it's obviously undervalued right now. Proceed at your own risk!

| Advantages | Disadvantages | Neutral |

|---|---|---|

|

|

|

Inside the LUB Numbers

| LUB Price (Luby's stock price per share) |

$0.00 | |

| PE Ratio versus Sector | 658% higher than other Consumer Goods stocks | |

| PE Ratio versus Industry | 393% higher than other Restaurants stocks | |

| Cash Yield | 9.86% | |

| Free Cash Flow Jitter | 33% |

Is Luby's Stock on Sale?

Based on our analysis, we believe that you should not buy Luby's right now. It might be a good stock to own—we just can't prove it with value analysis right now. Proceed with caution.

Should You Buy LUB Stock?

Does Luby's have a coherent story? Does it have a plan to continue to make money? Is it worth your time? Only you can decide where to go from here. Our investment guide helps you ask the right questions, including how to buy stocks. Use these research links for more information.

Most Popular Articles

When is the Right Time to Buy a Stock?

What is the Book Value of a Stock?

Are Annuities Good Investments?

Benjamin Graham, Value Investor

How to Make Money with Penny Stocks

How to Buy Dividend Paying Stocks

Rethinking Loss in the Stock Market