What is a Good Annual Rate of Return?

Understand how to evaluate investment returns, discount rates, and what realistic expectations look like for long-term value investing.

Should you buy Cesca Therapeutics stock? (NasdaqCM:KOOL). Let's see how it does in our automated value investing analysis system.

Advertisement helps keep Trendshare free for most readers.

Estimate how long you need to hold Cesca Therapeutics to reach your target.

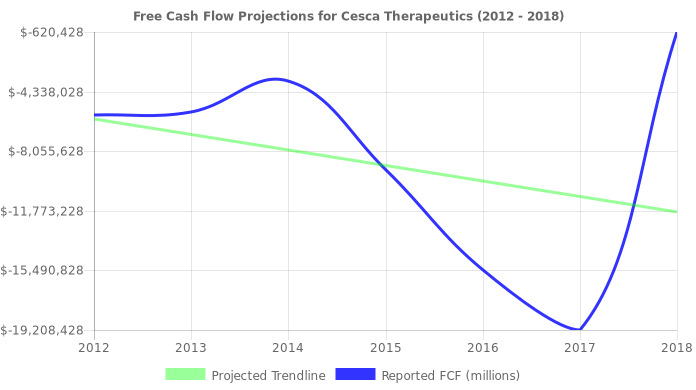

Hmm, we can't give any reliable projection for Cesca Therapeutics's growth rate. The company either has too few years of historical data for us to examine, or it's in the habit of losing money.

None of this means it's a bad stock. Maybe it's new and growing quickly, or maybe it's turning things around. We can't say anything sensible about it, so we won't say it's obviously undervalued right now. Proceed at your own risk!

| Advantages | Disadvantages | Neutral |

|---|---|---|

| None. |

|

|

Understand how to evaluate investment returns, discount rates, and what realistic expectations look like for long-term value investing.

Learn when dividend yields signal opportunity versus risk, and how to evaluate dividend sustainability in your portfolio.

Master the methods for projecting company growth rates and earnings, essential for calculating intrinsic value with confidence.

Based on our analysis, we believe that you should not buy Cesca Therapeutics right now. It might be a good stock to own—we just can't prove it with value analysis right now. Proceed with caution.

Advertisement supports free stock analysis content.

Does Cesca Therapeutics have a coherent story? Does it have a plan to continue to make money? Is it worth your time? Only you can decide where to go from here. Our investment guide helps you ask the right questions, including how to buy stocks. Use these research links for more information.

This example shows how we apply the Trendshare checklist to KOOL: earnings power, cash generation, valuation, and margin of safety.

We check: business quality, free cash flow, P/E, and margin of safety.

Most Popular Articles

What are The Dow, S&P 500, and NASDAQ Indexes?

Comparing Debt to Assets for Stocks

What is a Good Annual Rate of Return?

Is There a Secret Formula to Pick Good Stocks?

Should You Invest in the Highest Dividend Paying Stocks?

Should You Invest in Insurance Stocks?