Bluegreen Vacations Holding Corporation Stock Price and Value Analysis

Should you buy Bluegreen Vacations Holding Corporation stock? (NYSE:BBX). Let's see how it does in our automated value investing analysis system.

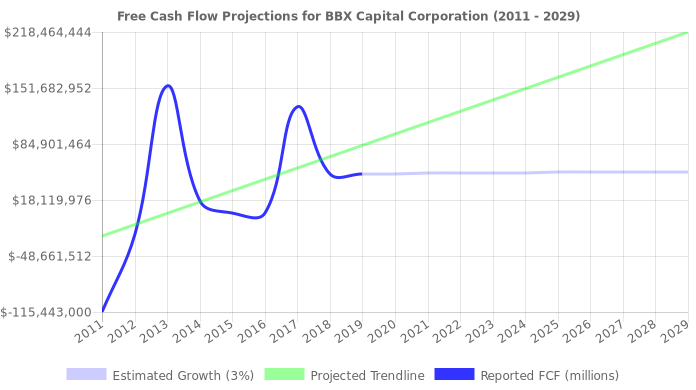

BBX Free Cash Flow Trend

Based on historical returns, we believe that Bluegreen Vacations Holding Corporation can grow its free cash at a rate of about 1%. That's positive!

| Advantages | Disadvantages | Neutral |

|---|---|---|

| None. |

|

|

Inside the BBX Numbers

| BBX Price (Bluegreen Vacations Holding Corporation stock price per share) |

$14.91 | |

|

|

BBX Fair Price (based on intrinsic value) |

$7.01 |

| BBX Safety Price (based on a variable margin of safety) | $4.21 | |

| PE Ratio versus Sector | 0% lower than other Unknown stocks | |

| PE Ratio versus Industry | 0% lower than other Unknown stocks | |

| Free Cash Flow Jitter | 228% |

Is Bluegreen Vacations Holding Corporation Stock on Sale?

We believe that Bluegreen Vacations Holding Corporation may be worth examining further. It's making money, which is a very positive sign. Is it on sale?

Bluegreen Vacations Holding Corporation looks overpriced right now. If you're looking for a bargain in the stock market, you should probably look elsewhere for a great deal. This might still be a great stock to own—but it's not on sale right now.

Should You Buy BBX Stock?

Does Bluegreen Vacations Holding Corporation have a coherent story? Does it have a plan to continue to make money? Is it worth your time? Only you can decide where to go from here. Our investment guide helps you ask the right questions, including how to buy stocks. Use these research links for more information.

Most Popular Articles

Is There a Secret Formula to Pick Good Stocks?

What is Portfolio Rebalancing?

What Does COVID-19 Mean for Stocks?

How Does Social Distancing Affect the Economy?

Should You Invest in Gold or Silver?

What is the Difference Between Trading Stocks and Investing?